A pair of 500-foot smokestacks rise from a natural-gas power plant on the harbor of Moss Landing, California, casting an industrial pall over the pretty seaside town.

If state regulators sign off, however, it could be the site of the world’s largest lithium-ion battery project by late 2020, helping to balance fluctuating wind and solar energy on the California grid.

The 300-megawatt facility is one of four giant lithium-ion storage projects that Pacific Gas and Electric, California’s largest utility, asked the California Public Utilities Commission to approve in late June. Collectively, they would add enough storage capacity to the grid to supply about 2,700 homes for a month (or to store about .0009 percent of the electricity the state uses each year).

The California projects are among a growing number of efforts around the world, including Tesla’s 100-megawatt battery array in South Australia, to build ever larger lithium-ion storage systems as prices decline and renewable generation increases. They’re fueling growing optimism that these giant batteries will allow wind and solar power to displace a growing share of fossil-fuel plants.

But there’s a problem with this rosy scenario. These batteries are far too expensive and don’t last nearly long enough, limiting the role they can play on the grid, experts say. If we plan to rely on them for massive amounts of storage as more renewables come online — rather than turning to a broader mix of low-carbon sources like nuclear and natural gas with carbon capture technology — we could be headed down a dangerously unaffordable path.

Small doses

Small doses

Today’s battery storage technology works best in a limited role, as a substitute for “peaking” power plants, according to a 2016 analysis by researchers at MIT and Argonne National Lab. These are smaller facilities, frequently fueled by natural gas today, that can afford to operate infrequently, firing up quickly when prices and demand are high.

Lithium-ion batteries could compete economically with these natural-gas peakers within the next five years, says Marco Ferrara, a cofounder of Form Energy, an MIT spinout developing grid storage batteries.

“The gas peaker business is pretty close to ending, and lithium-ion is a great replacement,” he says.

This peaker role is precisely the one that most of the new and forthcoming lithium-ion battery projects are designed to fill. Indeed, the California storage projects could eventually replace three natural-gas facilities in the region, two of which are peaker plants.

But much beyond this role, batteries run into real problems. The authors of the 2016 study found steeply diminishing returns when a lot of battery storage is added to the grid. They concluded that coupling battery storage with renewable plants is a “weak substitute” for large, flexible coal or natural-gas combined-cycle plants, the type that can be tapped at any time, run continuously, and vary output levels to meet shifting demand throughout the day.

Not only is lithium-ion technology too expensive for this role, but limited battery life means it’s not well suited to filling gaps during the days, weeks, and even months when wind and solar generation flags.

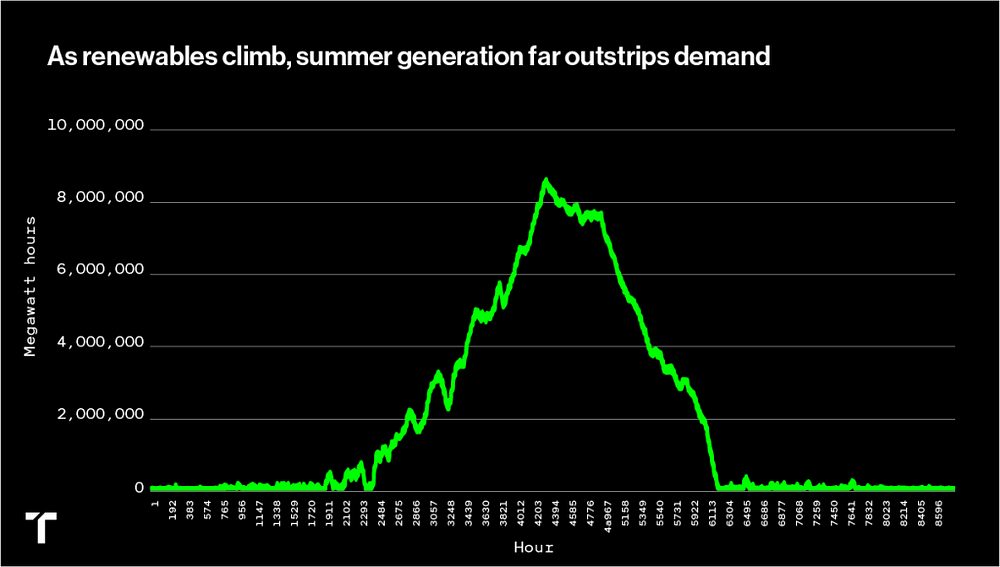

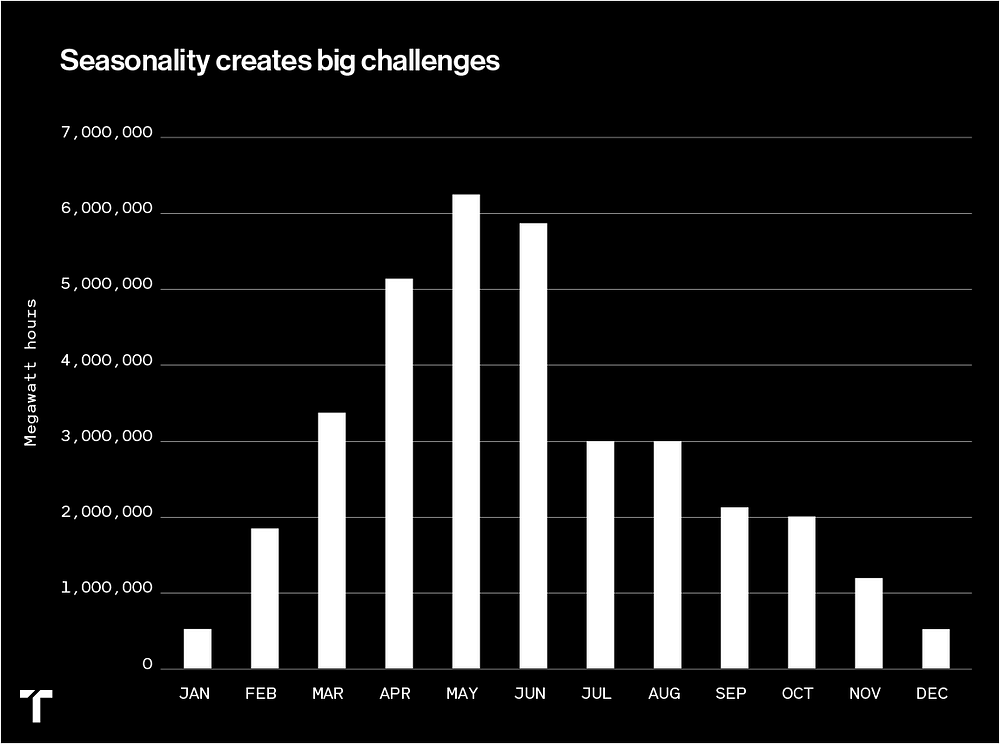

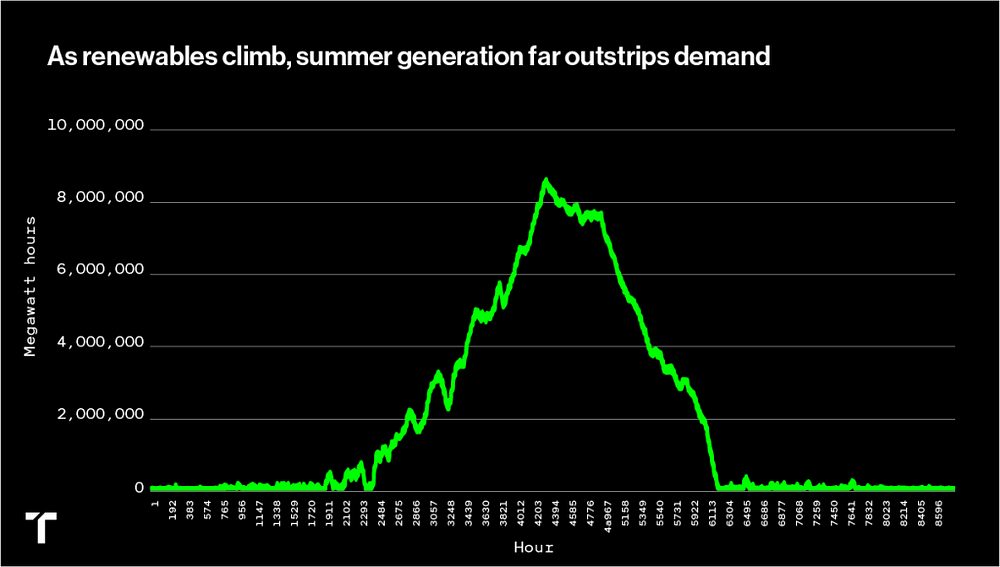

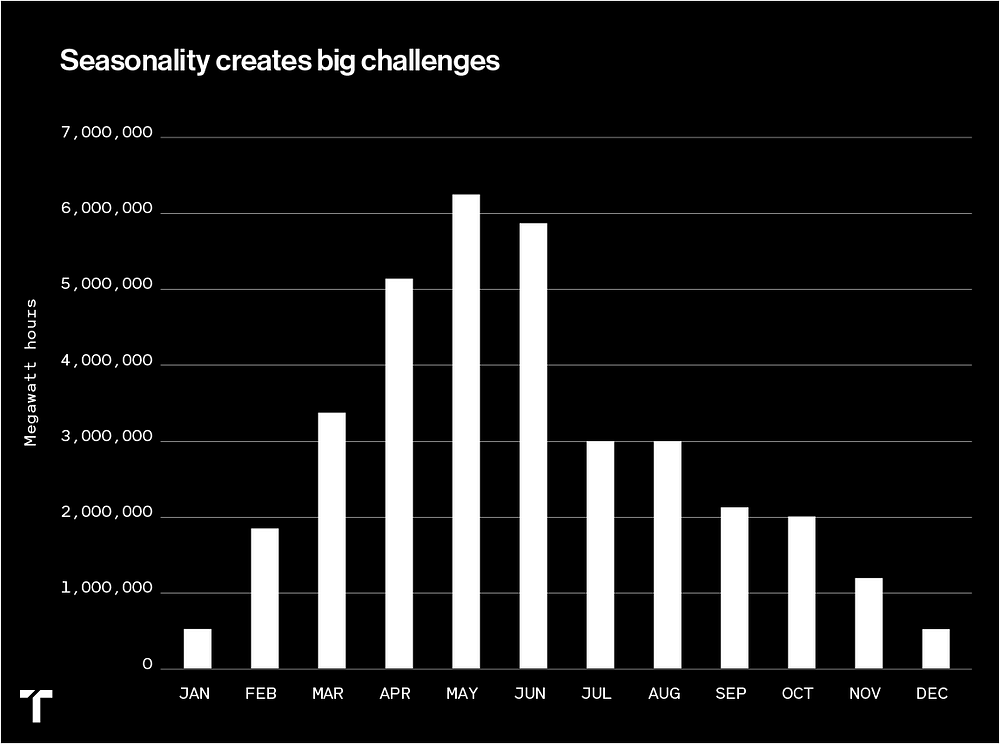

This problem is particularly acute in California, where both wind and solar fall off precipitously during the fall and winter months. Here’s what the seasonal pattern looks like:

If renewables provided 80 percent of California electricity — half wind, half solar — generation would fall precipitously beginning in the late summer. Data: CAISO; analysis: Clean Air Task Force

This leads to a critical problem: when renewables reach high levels on the grid, you need far, far more wind and solar plants to crank out enough excess power during peak times to keep the grid operating through those long seasonal dips, says Jesse Jenkins, a coauthor of the study and an energy systems researcher. That, in turn, requires banks upon banks of batteries that can store it all away until it’s needed.

And that ends up being astronomically expensive.

California dreaming

There are issues California can’t afford to ignore for long. The state is already on track to get 50 percent of its electricity from clean sources by 2020, and the legislature is once again considering a bill that would require it to reach 100 percent by 2045. To complicate things, regulators voted in January to close the state’s last nuclear plant, a carbon-free source that provides 24 percent of PG&E’s energy. That will leave California heavily reliant on renewable sources to meet its goals.

The Clean Air Task Force, a Boston-based energy policy think tank, recently found that reaching the 80 percent mark for renewables in California would mean massive amounts of surplus generation during the summer months, requiring 9.6 million megawatt-hours of energy storage. Achieving 100 percent would require 36.3 million.

The state currently has 150,000 megawatt-hours of energy storage in total. (That’s mainly pumped hydroelectric storage, with a small share of batteries.)

If renewables supplied 80 percent of California electricity, more than eight million megawatt-hours of surplus energy would be generated during summer peaks. Data: CAISO; analysis: Clean Air Task Force

Building the level of renewable generation and storage necessary to reach the state’s goals would drive up costs exponentially, from $49 per megawatt-hour of generation at 50 percent to $1,612 at 100 percent.

And that’s assuming lithium-ion batteries will cost roughly a third what they do now.

Read the full article here.

ACKLODGEMENTS: Paul Homewood Not a lot of people know that blog

James Temple